'Brain Drain' is a term often associated with the Indian Diaspora, but judging by the recent remittance flows data from 2023 World Bank report, Indian Diaspora has been contributing to a record financial gain for the motherland – India.

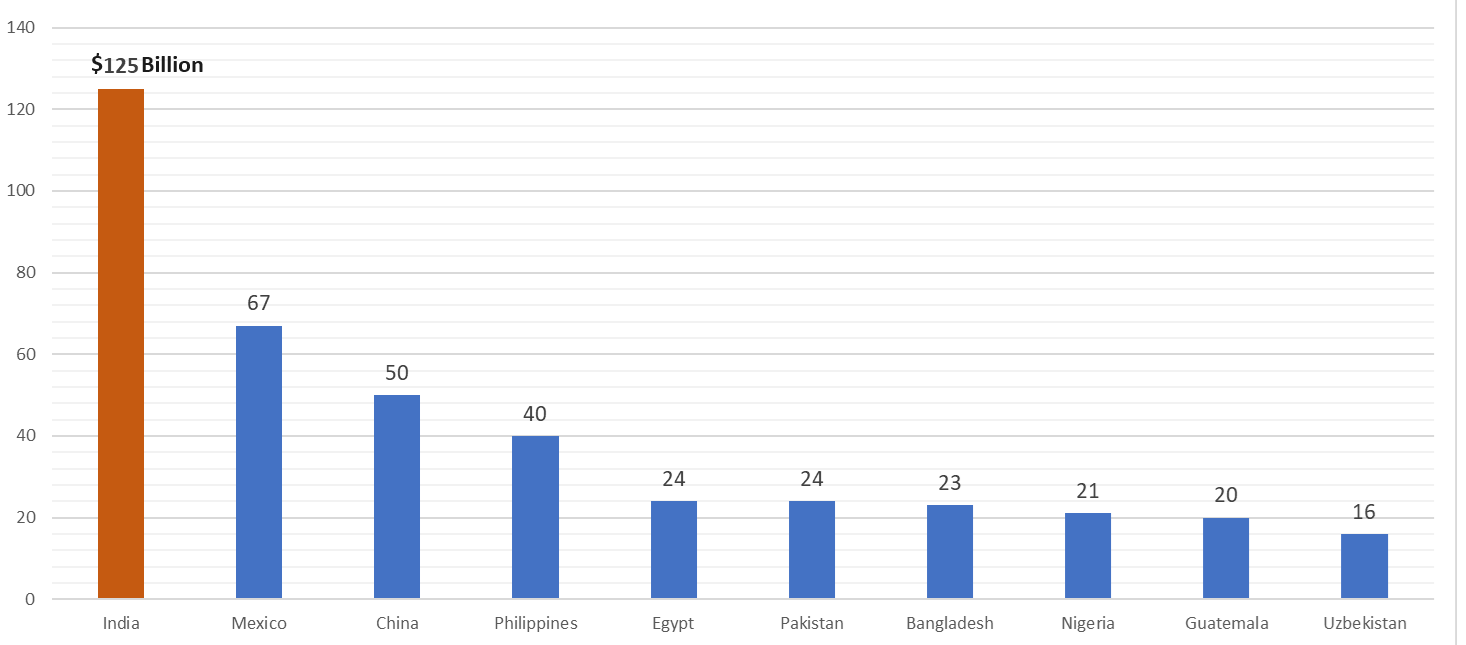

India has topped the list of remittance recipient countries in the world, with a total of $125 billion sent by Indians living in different parts of the world to their families in India.

As per the report, the total remittance flow to low- and middle-income countries amounted to $669 billion in 2023. While the average growth in low- and middle-income countries was 3.8 percent, remittance inflow grew 7.2 percent in South Asia. The total remittance inflow to South Asia was about $189 billion, of which India's share was almost 66 percent. Mexico and China stand in second and third place with a remittance inflow of $67 billion and $50 billion respectively.

The World Bank further said growth in remittances in India is expected to halve to 12.4 per cent in 2023 from a historic peak of 24.4 per cent in 2022.

“Remittances are expected to increase by USD 14 billion and rise to USD 125 billion in 2023, increasing India’s share in South Asian remittances to 66 per cent in 2023 from 63 per cent in 2022,” said the World Bank’s latest Migration and Development Brief.

Image: Top Recipients among Low and Middle Income Countries, 2023

The United States, the United Kingdom, and Singapore are the most significant contributors to the remittance inflow in India. The money sent from these three countries amounts to 36 percent of India's total remittance inflow. Gulf Cooperation Council (GCC) countries are the second most prominent contributors to India's remittance inflow, with the United Arab Emirates alone contributing 18 percent to the total inflow. The UAE is the second-largest contributing country to India’s remittances after the United States.

According to the report, some initiatives by the government, such as UPI linkage between India and Singapore for cross-border remittance, have highly contributed to the growth in remittance inflow. Similarly, the use of the dirham-rupee and cooperation in interlinking payments between India and the UAE have also paced the growth of the remittance flow between the two countries.

Furthermore, India has implemented non-residential deposit programmes to attract foreign currency from non-residential Indians. The non-residential deposits in India amounted to $143 billion in September 2023. India's non-residential deposits have also increased by $10 billion this year.

Remittance costs also play a big part in the remittance flow between the countries. South Asia has the lowest remittance costs among all regions of the world. While the average global remittance amounted to 6.2 percent, it was 4.3 percent in South Asia. Remittance costs between India and Malaysia are the lowest in the world. The average remittance cost for India and Malaysia is at 1.9 percent.

According to the report, the main factors for the increase in remittance inflow in India are the strong labor markets and the declining inflation in the high-income source countries of the West and Middle East. Furthermore, the report projects an 8 percent increase in India's remittance inflow in the coming year. If these estimates come true, India's total remittance inflow will be $135 billion in 2024.

393 Views

393 Views 0 comments

0 comments

Comments